Current Bridge / Hard Money Loan Rates (Q4 2024)

Private loan interest rates tend to be higher than many other loans. Learn about current rates and what factors lenders consider when setting rates.

Private lenders, including hard money lenders like Capstone Capital Partners, can often provide financing faster than traditional lenders. They can offer more flexible loan terms and work with borrowers to help meet their needs. While many institutional lenders can only offer “one size fits all” loans, private lenders can offer more customizable products. The trade-off for these benefits often comes in the form of higher interest rates. Private lenders take greater risks when they loan money since they don’t have the protections that come with regulation. They charge more in interest to offset that risk. Read on to learn more about current interest rates for hard money and bridge loans, the factors that may influence interest rates, and how today’s rates compare to rates in the past.

Photo by Kaboompics.com on Pexels

How long do hard money and bridge loans take to close?

In the current market environment, Capstone Capital Partners has been charging an average interest rate of 11% to 12%. This is specific to our company, but these are competitive rates in the private lending industry.

What factors affect interest rates for hard money and bridge loans?

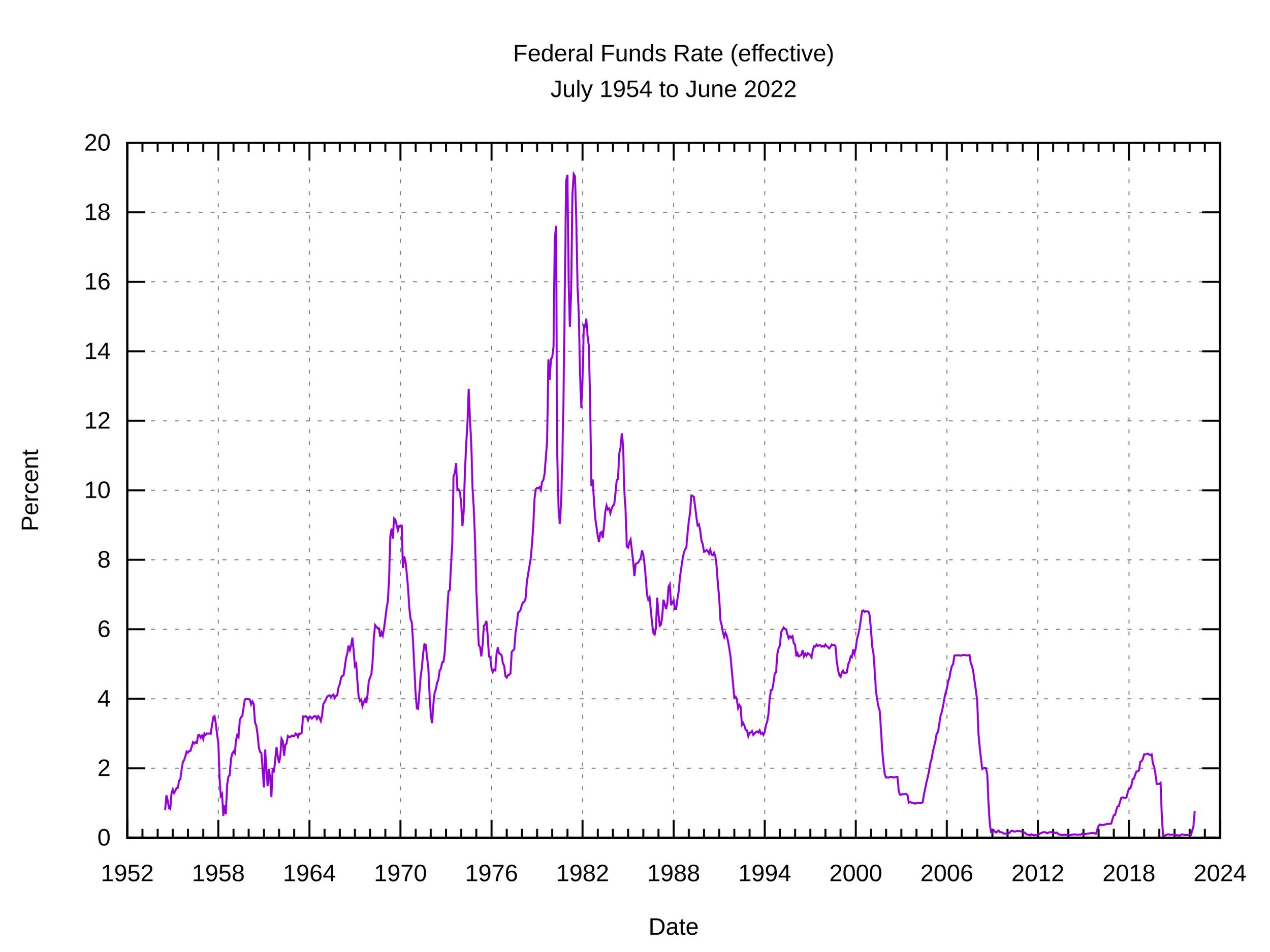

When a private lender sets an interest rate for a loan, they are looking at numerous factors. Some factors, such as market conditions, are outside of either the borrower’s or the lender’s control. The federal funds rate set by the Federal Reserve, for example, is the starting point for almost all other interest rates in the U.S. economy. When the Fed raises or lowers that rate, other rates will rise or fall accordingly.

At a more local level, economic conditions in a particular area may affect how much interest a lender will charge. The more risk a lender perceives in a loan, the higher the interest rate is likely to be.

Other factors are specific to the borrower or the property they want to purchase. These are often within a borrower’s control, so they are worth discussing further.

Image by EFAFLEX_Schnelllauftore from Pixabay

Asset Class

The type of property involved in the deal can affect the interest rate. Real estate mostly falls into two broad categories: residential and commercial.

Residential property includes single-family homes, townhomes, duplexes, and other types of dwellings.

Multifamily residential property can be more difficult to categorize. It may be considered commercial property in some situations, even though people live there. Most multifamily properties require management, which adds a commercial dimension.

Commercial property includes office space, retail locations, warehouses, and other properties with non-residential use.

Some cities have separate zoning categories for industrial use, but this can also be considered another type of commercial property.

Private lenders will look at the asset class when assessing the risk that a project presents.

Residential property is generally considered to be the least risky, although this may depend on other factors, such as location and property condition.

Commercial property is often seen as riskier for various reasons. It tends to have fewer regulations that protect property owners, and commercial provides less certainty about a property’s potential.

Undeveloped land tends to be the riskiest asset class of all. It has no economic history, so it is largely a guessing game as to whether it will yield returns or not.

Experience

Hard money lenders place greater focus on the property, rather than the borrower, unlike conventional lenders who do deep dives into loan applicants’ credit histories. This does not mean that the borrower goes unexamined when applying for a hard money or bridge loan.

Lenders are investing in a real estate project. They want the borrower to succeed so the borrower can repay the loan and start more projects with more loans. The more experience a borrower has with a particular type of project, the more confident the lender will feel, the less risk they will perceive, and the lower interest rate they will charge. For example, a borrower with dozens of successful fix-and-flip projects under their belt might get a lower interest rate than a borrower trying a fix-and-flip for the first time.

Liquidity

Real estate projects require money before they can make money. Private lenders provide financing for these projects, but they don’t necessarily want to be the only source of funding. The more money a borrower can bring to the table, the more a lender might feel comfortable charging less interest. This might involve making a larger down payment or having more than enough cash on hand for the planned renovations or improvements.

Loan-to-Value Ratio

Private lenders tend to prefer a loan-to-value ratio (LTV) of around 70%. This means that the lender is providing 70% of the purchase price of the property. For a $1 million property, the lender would provide $700,000.

If a borrower can put up more money to reduce the LTV, the lender might lower the interest rate. If the borrower needs a bigger loan, and the lender agrees to a higher LTV, the interest rate will go up.

Relationship with the Lender

The saying “It’s not what you know, it’s who you know” has some truth in the private lending business. Lenders like developing long-term business relationships with borrowers. Over time, they build up trust, which lowers the perception of risk. Less risk means lower interest rates.

Capstone, to give one example, will consider how long a client has been with the company and how many successful deals they have done. These factors can be cause for a discount on interest rates.

Image by "Wikipedian Kbh3rd" via Wikimedia Commons [Creative Commons]

What have private loan interest rates been in the past?

It’s not easy to talk about historic interest rates for private loans. This is largely due to a lack of data. Minimal regulation means that no one has to keep an eye on industry-wide trends. While the Fed has data on various interest rates going back decades, private loans tend to escape notice.

The shifting fortunes of the private lending industry are another factor that makes historical comparisons difficult. The term “hard money” dates back at least as far as the Great Depression of the 1930s, and short-term real estate loans became fairly common in the 1950s. The current hard money loan industry, however, owes much of its success to frustration with mainstream banking after the 2008 financial crash. That would still give us over a decade of data, but again, that would require someone to compile the data.

All of that said, it is possible to extrapolate what interest rates might have been like in recent years. The Fed tracks numerous interest rates, and many of them have similar-looking graphs. If you compare the graphs showing the federal funds rate, the prime rate, and personal loan interest rates, the numbers aren’t the same but the shapes are quite similar. This illustrates how many interest rates rise and fall together.

Based on that comparison, it would seem like interest rates are higher now than they were before the Fed began raising the federal funds rate in 2022. Prior to that, many rates were at or near all-time lows from 2019 to 2021. Rates also dropped considerably in 2008.

Where do the experts think private loan rates are heading?

Predicting where interest rates will go in any industry is often a combination of expertise, experience, and guessing. Experts within the private lending industry have opinions to spare. To get a broader sense of what might be in store, though, it might be best to look where all interest rates originate. The Fed has received extensive media coverage over the past two years because of historic rate increases followed by recent decreases.

After lowering the federal funds rate in September, the Fed issued a statement that suggests further cuts are coming: “Recent indicators suggest that economic activity has continued to expand at a solid pace.” This suggests that private lending interest rates will remain stable, or maybe even go down, but they are less likely to go up.

Learn more about Capstone Capital Partners’ loan opportunities

Capstone Capital Partners provides fast and flexible financing across Texas. If you've found a good real estate opportunity and you're content with current interest rates, DO NOT wait to buy! We will evaluate your plan and help you find the financing you need. Contact us today to get started on your free pre-approval.