For Investors: 2024's Highest & Cheapest Rent Areas in Texas

While private lenders offer unique benefits, their interest rates are often higher than conventional. What determines rates for each?

While some factors determining interest rates relate to the overall condition of the economy, others are specific to each loan applicant. The type of loan also influences how interest rates are determined.

Conventional mortgage lenders tend to look at individual factors like credit history, but private lenders often pay more attention to the property (its current condition, and its potential value) and different aspects of the borrower such as past projects and liquid reserves. Read on to learn more about how interest rates are determined for private loans, including hard money loans.

What determines the interest rate of a private mortgage loan?

Private loans for the purchase of real property are not subject to as many regulations and restrictions as conventional mortgages and government-backed loan programs. This gives lenders greater flexibility to structure loans that meet borrowers’ unique needs. Hard money lenders, for example, can provide loans to real estate investors that are customized for particular projects.

The flip side of greater flexibility for lenders is greater risk. A lender takes a risk every time they make a loan. They risk a borrower defaulting, which means they will have to incur expenses trying to recover the balance of the loan. Interest payments provide them with income to offset the risk of loss. Loans with greater risk, therefore, tend to have higher interest rates.

The following factors can affect interest rates for private mortgage loans:

The type of property

Photo from Rawpixel

Real estate investors may borrow money from a private lender to purchase a wide variety of properties (and close faster). The type of property can influence the interest rate. Some real estate investment projects are riskier than others. Lenders tend to view residential property as less risky than commercial property. Vacant land is often the riskiest of all since it can be difficult to predict its value or income potential.

The property’s appraised value

An appraisal provides information about a property’s current condition, including factors like:

The size of the property

The size of any structures on the property

The condition of those structures

The need for improvements or renovations to make the property more marketable

This information can help a lender assess the risk of lending money for the property, which will affect the interest rate they will offer.

The property’s location

As the old saying goes, location is critically important for the success of a real estate investment. A property in an area with a proven track record for the investor’s project, such as residential property in a “hot” or “up and coming” neighborhood, could get a better interest rate than one located elsewhere.

The property’s after-repair value

Since private mortgages and hard money loans place more emphasis on the property rather than the borrower, the property’s potential is a major factor when evaluating a loan application. A property’s after-repair value (ARV) represents what it will be worth when the investor completes their repairs, renovations, or improvements.

Relevant market conditions

Private mortgage lenders are subject to many of the same market pressures as other lenders. Many external factors can cause interest rates to rise or fall. The overall state of the economy is only one influence. Decisions by policymakers also affect interest rates.

The Federal Reserve (the “Fed”) plays a major role in interest rates. It sets the federal funds rate, which is central to much of the national economy. Raising or lowering this rate affects many other interest rates. It does not directly impact private mortgage and hard money lenders, as discussed more below, but it can be a factor.

Factors specific to the borrower

The property and its potential are the primary considerations for many private mortgages and hard money loans. This does not mean that a borrower’s personal finances are not relevant, though. Lenders may consider factors like credit scores, especially with a new or inexperienced investor.

Legal restrictions on interest rates

State usury laws limit how much lenders may charge in interest, but many states provide a wide range of exceptions. The Texas Finance Code sets the usury limit at 10%, “except as otherwise provided by law.” The law otherwise provides many ways around that limit.

The Texas Office of Consumer Credit Commissioner (OCCC) has the authority to set rate ceilings for consumer and commercial loans. Every week, it publishes the Texas Credit Letter to report the current rate ceilings.

What determines interest rates for conventional lenders?

Photo by Binyamin Mellish on Pexels

Conventional mortgages are consumer-oriented. Lenders tend to focus on factors that affect loan applicants’ creditworthiness. Plus, conventional lenders are subject to strict regulatory guidelines.

Market conditions and the federal funds rate

The rates that a conventional mortgage lender can offer are subject to what the market will allow. They also depend on decisions by the Fed regarding the federal funds rate. If that rate goes up, conventional mortgage rates will also go up. If it goes down, so will mortgage rates.

Fannie Mae and Freddie Mac

Conventional mortgages are subject to regulations set by Fannie Mae and Freddie Mac. These include maximum loan amounts and, in some cases, interest rate restrictions.

Credit score

A credit score provides a snapshot of a loan applicant’s overall financial condition. Lenders often have a minimum credit score requirement to qualify for a loan. A credit score above a certain amount could result in a lower interest rate.

Debt-to-income ratio

The debt-to-income ratio (DTI) divides a loan applicant’s total monthly debt payments by their monthly income. Lenders set a maximum DTI and may offer a lower interest rate for a lower DTI.

Sales price of the property

The more a loan applicant needs to borrow, the greater the risk for the lender. Larger loans often mean higher interest rates.

Amount of the down payment

The more a borrower can contribute to the purchase price at closing, the less money they will need from the lender. A larger down payment can lead to a lower interest rate.

Term of the loan

Conventional mortgage lenders often charge higher interest rates for longer-term loans. A 15-year loan, for example, might have a lower rate than a 30-year loan for the same amount.

Type of interest rate

Conventional mortgages can have fixed or adjustable rates. An adjustable-rate mortgage (ARM) starts out with a lower interest rate than a fixed-rate mortgage. That rate, however, could increase quite a bit at a later date.

Points

Borrowers might be able to buy discount points in order to lower their interest rate. One “point” typically costs 1% of the loan amount, and can reduce the interest rate by 0.25% to 0.5% in many cases.

Suppose a homebuyer is borrowing $400,000 to buy a home at an interest rate of 6%. They can buy one point for $4,000. This might result in a 5.5% or 5.75% interest rate.

Do Fed rates affect hard money lenders?

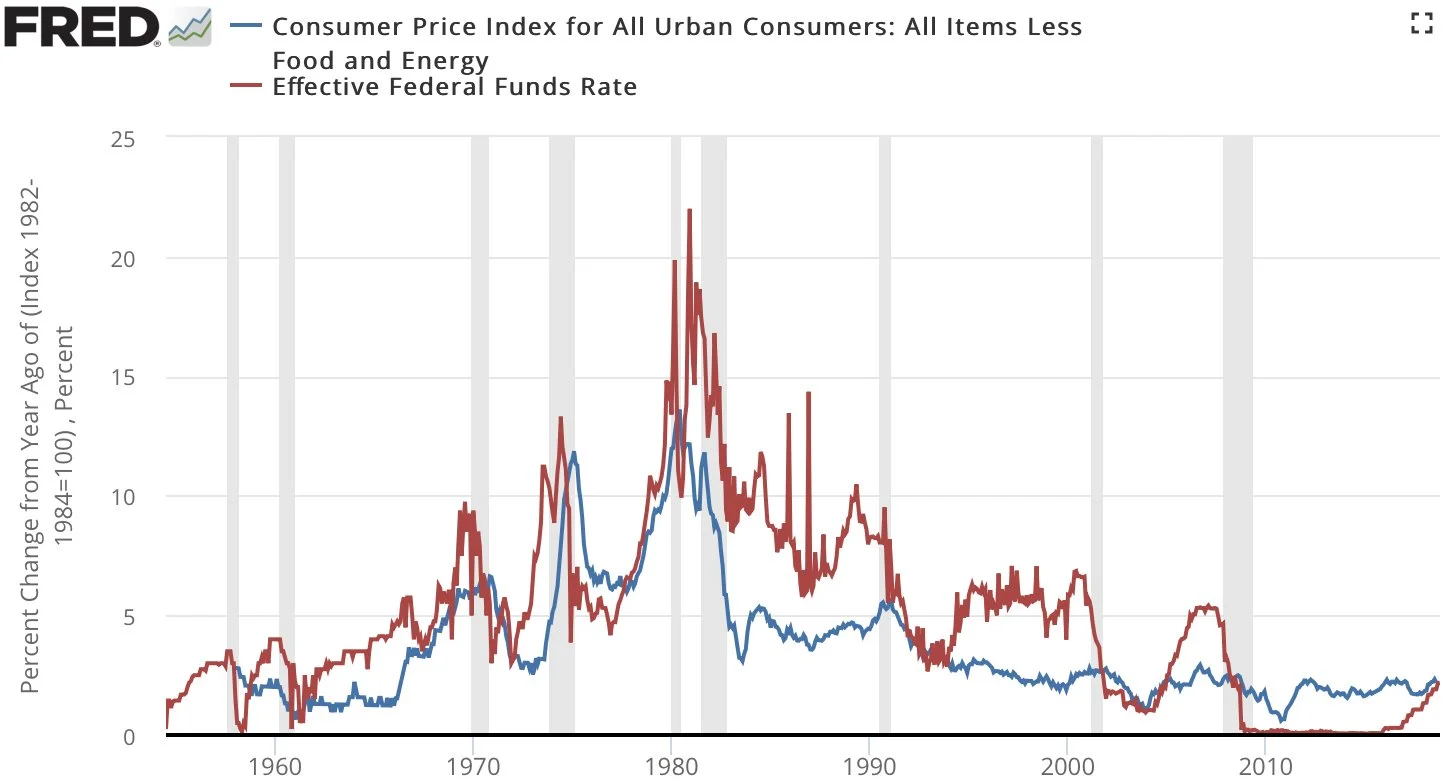

Image by U.S. Bureau of Labor Statistics, Board of Governors of the Federal Reserve System, FRED, via Wikimedia Commons [Public domain]

The short answer is that rate changes by the Fed do not directly affect hard money lenders. The word “directly” is important.

The Fed sets the federal funds rate. This is the rate for loans between large commercial banks, so raising or lowering it has ripple effects throughout the economy. If large commercial banks have to pay more interest on loans, they will charge more interest on loans to smaller banks. Those banks will charge more on loans to mortgage lenders, and so on.

Hard money lenders and many other private lenders are not part of the system affected by the federal funds rate. A hard money lender will not change their interest rates solely based on what the Fed decides to do.

This is not to say, however, that rate changes from the Fed are irrelevant to hard money lending. The effect on the economy could be a factor when a lender is evaluating a loan application. It’s just not the only factor, or even a major one.

Partner with a trusted private lender

Since 2006, Capstone Capital partners has provided fast and flexible financing to real estate investors for a range of commercial and residential projects. Our team knows and loves real estate, and we understand what you need as a borrower. You’ll feel personally cared for and listened to as we gain your trust through our easy process.

Tell us about your next project, and let’s explore your options!